Commodity Firms Adopt Futures Strategies to Mitigate Risk

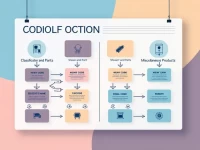

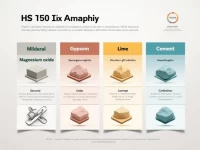

Cash-futures combination is a crucial strategy for enterprises to mitigate commodity price volatility, stabilize operations, and enhance value. Through hedging, basis trading, exchange for physicals (EFP), and pricing to be fixed (PTBF) transactions, companies can effectively manage risk, optimize inventory, lock in costs, and potentially profit from market fluctuations. Establishing a robust cash-futures integration system is essential for modern enterprises to achieve sustainable development, enabling them to navigate market uncertainties and secure long-term profitability.